protopshop.ru

Prices

Revenue Recognition Concept

:max_bytes(150000):strip_icc()/Revenuerecognition-f7a78c38114c47399302a7b8073aa31c.jpg)

What is Revenue Recognition Principle? The Revenue Recognition Principle dictates when and how revenue is recognized in financial statements. It requires. Revenue is recognized when the deposit is received, but it is recorded as a liability until the cancellation period has expired or the customer has fulfilled. REVENUE RECOGNITION · Removes inconsistencies and weaknesses in existing revenue requirements · Provides a more robust framework for addressing revenue issues. If you get paid to provide a service for a month or a year, but you receive the money immediately, that payment should be gradually recognized as revenue. Each. ASC directs entities to recognize revenue when the promised goods or services are transferred to the customer. The amount of revenue recognized should equal. The revenue recognition principle states that revenue is recognizable when companies meet certain milestones or during specific accounting periods. The revenue recognition principle dictates the process and timing by which revenue is recorded and recognized as an item in a company's financial statements. The revenue recognition principle is a fundamental accounting concept that dictates how and when revenue should be recorded in the financial statements. Revenue recognition is the generally accepted accounting principle (GAAP) referring to the way a company records revenue earned. What is Revenue Recognition Principle? The Revenue Recognition Principle dictates when and how revenue is recognized in financial statements. It requires. Revenue is recognized when the deposit is received, but it is recorded as a liability until the cancellation period has expired or the customer has fulfilled. REVENUE RECOGNITION · Removes inconsistencies and weaknesses in existing revenue requirements · Provides a more robust framework for addressing revenue issues. If you get paid to provide a service for a month or a year, but you receive the money immediately, that payment should be gradually recognized as revenue. Each. ASC directs entities to recognize revenue when the promised goods or services are transferred to the customer. The amount of revenue recognized should equal. The revenue recognition principle states that revenue is recognizable when companies meet certain milestones or during specific accounting periods. The revenue recognition principle dictates the process and timing by which revenue is recorded and recognized as an item in a company's financial statements. The revenue recognition principle is a fundamental accounting concept that dictates how and when revenue should be recorded in the financial statements. Revenue recognition is the generally accepted accounting principle (GAAP) referring to the way a company records revenue earned.

Under the cash basis of accounting the revenue recognition principle requires that revenue is recognized when cash is received. Under the accrual method of. Revenue recognition is a valuable principle in accounting because it helps businesses accurately record and report their financial performance. Revenue. The revenue recognition principle states that companies should record their revenues when they are recognised or earned (not only when the cash is actually. According to the matching principle, expenses should be recognized in the same period as the related revenues. If expenses are recorded as they are incurred. The revenue recognition principle dictates that revenue is recorded when earned, not when payment is received. The key principle in accounting is that an organisation recognises revenue when it's earned, not when the money is received. This means the model accounts for. The core principle is that an entity recognizes revenue to depict the transfer of promised goods or services to a customer in an amount that reflects the. Revenue recognition is a key accounting principle that dictates when the recording of revenue is appropriate. It shapes the formula organizations must. The revenue recognition standard (ASC ) provides a comprehensive, industry-neutral model for recognizing revenue from contracts with customers. Revenue Recognition Principle The revenue recognition principle is a guiding principle that helps companies identify when they can recognize and record. Revenue recognition is the accounting principle that governs when and how much revenue can and should be recognized by an entity. Revenue recognition is an accounting principle that outlines the specific conditions under which revenue is recognized. In theory, there is a wide range of. Revenue recognition is a fundamental aspect of the SaaS accounting accrual basis and a generally accepted accounting principle (GAAP). According to the accrual method of accounting, revenue is recognized when earned and expenses are recognized when incurred. As a fundamental principle in financial accounting, revenue recognition dictates that the revenue of a company needs to be included in that company's financial. Revenue is measured at the fair value of the consideration received or receivable and recognised when prescribed conditions are met, which depend on the nature. In accounting, the revenue recognition principle states that revenues are earned and recognized when they are realized or realizable, no matter when cash is. The core principle of recognizing revenue is that an entity recognizes revenue to depict the transfer of promised goods or services to customers. This principle is intended to eliminate and mitigate against any overstatements in revenue. IU uses accrual accounting where revenues are recognized when. Q. AS−9 (Revenue recognition) is concerned with the recognition of revenue arising in the course of the ordinary activities of the enterprise from ______.

Mir Token

MIR is the governance token of Mirror Protocol, a synthetic assets protocol built by Terraform Labs (TFL) on the Terra blockchain. Market. Volume (24H). MIR is a Token to fund the future of Blockchain, an optimization model of two types: Blockchains that will be able to carry billions of transactions per day. MIR is an Ethereum token that governs the Mirror Protocol which “allows the creation of fungible assets, that track the price of real world assets.”. The all-time high price of Mirror Protocol (MIR) is $ The current price of MIR is down % from its all-time high. Track current MIR TOKEN prices in real-time with historical MIR USD charts, liquidity, and volume. Get top exchanges, markets, and more. For those who have not yet created their account in Japap Messenger, the Web social network which integrates crypto and mainly $MIR TOKEN, do so now by. The price of Mirror Protocol (MIR) is $ today, as of Aug 28 a.m., with a hour trading volume of $83, Over the last 24 hours. MIR token govern the network including both code changes and on-chain treasury. Terraform Labs doesn't intend to hold or sell any of the MIR tokens; the. Both $MIR and $ANC have been delisted as collateral types on Mirror Protocol now that proposals and have been executed. MIR is the governance token of Mirror Protocol, a synthetic assets protocol built by Terraform Labs (TFL) on the Terra blockchain. Market. Volume (24H). MIR is a Token to fund the future of Blockchain, an optimization model of two types: Blockchains that will be able to carry billions of transactions per day. MIR is an Ethereum token that governs the Mirror Protocol which “allows the creation of fungible assets, that track the price of real world assets.”. The all-time high price of Mirror Protocol (MIR) is $ The current price of MIR is down % from its all-time high. Track current MIR TOKEN prices in real-time with historical MIR USD charts, liquidity, and volume. Get top exchanges, markets, and more. For those who have not yet created their account in Japap Messenger, the Web social network which integrates crypto and mainly $MIR TOKEN, do so now by. The price of Mirror Protocol (MIR) is $ today, as of Aug 28 a.m., with a hour trading volume of $83, Over the last 24 hours. MIR token govern the network including both code changes and on-chain treasury. Terraform Labs doesn't intend to hold or sell any of the MIR tokens; the. Both $MIR and $ANC have been delisted as collateral types on Mirror Protocol now that proposals and have been executed.

Live MIR Price Analysis. The current real time Mirror Protocol price is $, and its trading volume is $58, in the last 24 hours. MIR price has plummeted. Mirror Protocol is a decentralized finance (DeFi) platform that enables users to issue synthetic assets, which are crypto tokens that track the price of real-. Mirror Protocol is a decentralized finance (DeFi) platform that allows users to create synthetic assets or crypto tokens that mimic the price of real-world. Mir is the governance token of mirror protocol, which is a synthetic asset protocol built by terrain labs (TFL) on the terra blockchain. The price of Mir Token (MIR) is $ today with a hour trading volume of $10, This represents a % price decline in the last 24 hours and a. This guide will show you how to buy MIR Token by connecting your crypto wallet to a decentralized exchange (DEX) and using your Binance account to buy the base. Token holders can stake their MIR tokens to contribute to the protocol's governance and earn rewards. Additionally, staking MIR tokens grants users voting power. The Mirror token (MIR) is minted by the protocol and distributed as a reward to nodes who help secure the ecosystem. Mirror Protocol (MIR) Price Today. The. This is the same company behind the development of the Terra blockchain (and the LUNA token). Synthetic assets, or also called synthetic tokens, are crypto. MIR is the governance token of Mirror Protocol, a synthetic assets protocol built by Terraform Labs (TFL) on the Terra blockchain. MIR is the governance token of Mirror Protocol, a synthetic assets protocol built by Terraform Labs (TFL) on the Terra blockchain. About Mirror Protocol. MIR is an Ethereum token that governs the Mirror Protocol which “allows the creation of fungible assets, that track the price of real. Get the latest Mir Token price, MIR market cap, charts and data today. The live Mir Token price today is $ with a market cap of M and a hour. Cumulative Distribution Schedule (in millions) Total of M tokens are available at genesis of Mirror Protocol. The distribution of these tokens will be. Get the latest and historical MIR TOKEN price, MIR market cap, trading pairs, and exchanges. Check the charts, MIR to USD calculator. Get MIR COIN price today, with MIR to USD charts updated in real-time. Explore latest MIR news, research, and fundraising. MIR is Mirror's native token. It was originally made available to Terra liquidity providers through Uniswap and Terraswap between 11th of November and 4th of. MIR Token price stands at $, with market cap of $0 and circulating supply of 0. MIR Token price is up +% in the last 24 hours and up +%. MIR is the utility token of the protocol and plays an integral role in the governance system. MIR can be staked to get voting rights, so users can earn a share. See relevant content for protopshop.ru

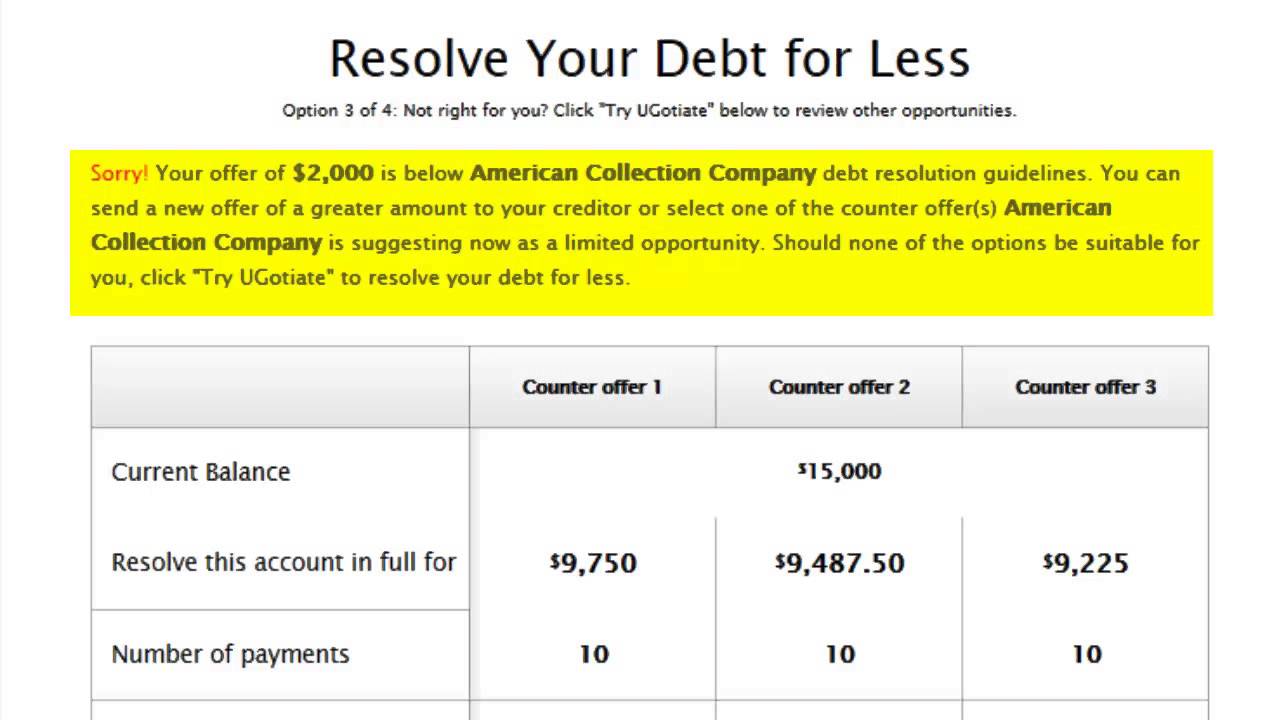

Best Debt Resolution Programs

Credit counseling can help you create a debt management plan, which allows you lump all of your debts into a single monthly payment — often at a lower interest. Undue Medical Debt makes it easy for donors to make an impactful difference in the lives of those struggling with medical debt. National Debt Relief: Best overall debt relief company 24 to 48 months after enrolling in the program. Closing fee of 15% to 25% of your enrolled debt. Offered by for-profit companies, debt settlement is a service that allows clients to pay back only a portion of the debt they owe. It only takes 1 minute and won't affect your credit score! Better Business Bureau On average, our debt consolidation programs range from months in. Write off up to 80% of your unaffordable debt · Reduce debts into one affordable monthly payment · Government-Legislated Debt Relief Program · No interest and. Compare the top debt settlement and debt management services programs · National Debt Relief · CreditAssociates Debt Relief · Accredited Debt Relief · American. New Era is a top-rated debt relief company helping consumers get out of credit card debt without bankruptcy or loans since Start today with no upfront. National Debt Relief is proud to be the most respected provider of debt relief services in the country. We're A+-rated and fully accredited with the Better. Credit counseling can help you create a debt management plan, which allows you lump all of your debts into a single monthly payment — often at a lower interest. Undue Medical Debt makes it easy for donors to make an impactful difference in the lives of those struggling with medical debt. National Debt Relief: Best overall debt relief company 24 to 48 months after enrolling in the program. Closing fee of 15% to 25% of your enrolled debt. Offered by for-profit companies, debt settlement is a service that allows clients to pay back only a portion of the debt they owe. It only takes 1 minute and won't affect your credit score! Better Business Bureau On average, our debt consolidation programs range from months in. Write off up to 80% of your unaffordable debt · Reduce debts into one affordable monthly payment · Government-Legislated Debt Relief Program · No interest and. Compare the top debt settlement and debt management services programs · National Debt Relief · CreditAssociates Debt Relief · Accredited Debt Relief · American. New Era is a top-rated debt relief company helping consumers get out of credit card debt without bankruptcy or loans since Start today with no upfront. National Debt Relief is proud to be the most respected provider of debt relief services in the country. We're A+-rated and fully accredited with the Better.

Debt Relief Program · is a · designed to help individuals who are struggling with debt ·. The program aims to reduce credit card debt by up to half and offers a. 1. Make a Personal Budget and Debt Repayment Plan · 2. See a Credit Counsellor · 3. Debt Management Program · 4. Debt Consolidation Loan · 5. Debt Settlement · 6. Debt settlement, also called debt relief or debt adjustment, is the process of resolving outstanding debt for far less than the amount you owe by promising the. FREED: Your path to financial freedom! Say goodbye to debt with our trusted Debt Resolution Program. Resolve debts, regain control. Debt settlement programs are typically offered by for-profit companies to people with significant credit card debt. The companies negotiate with your creditors. United Way of Florida. United Way of Florida offers various services that can assist you in dealing with debt. They provide community resources, financial. Debt Management Programs. We work with your creditors to get you debt relief now, in the form of lower interest rates, waived credit card fees and lower credit. For some it's not worth the fees but for others it's a life line. People need to decide for themselves the best option for them. They aren't a. National Debt Relief Services offers Canadians a way to save up to 75% on their debt in days using a Government Approved Debt Forgiveness Program. Debt settlement is an agreement made between a creditor and a consumer in which the total debt balance owed is reduced and/or fees are waived. Debt consolidation is an effective financial strategy for eliminating credit card debt. It reduces your interest rate and monthly payment so you pay off debts. Contact a certified credit counselor from the nonprofit debt management companies like Take Charge America, In Charge Debt Solutions, or Ntional. Debt resolution: Means convincing your creditors to accept less than you owe as payment in full. They may be willing to do so if you cannot afford to repay the. TopTenReviews – rated #1 for Debt Settlement; ConsumersAdvocate – rated #1 for Debt Settlement; ConsumerAffairs – rated #1 for Debt Settlement; 46, reviews. National Debt Relief is the top choice because it will accept clients with $7, of debt and is available in 41 states, the most of any of the companies. They. What is the the Best Debt Relief Option? · Do-It-Yourself debt reduction · Debt settlement plans (DSPs) · Credit counseling and a debt management plan · Bankruptcy. If you're struggling to pay existing or growing debts, you can hire the services of a debt settlement company to help you manage those debts and create a plan. Debt relief is the core of National Debt Relief's signature solution. It can cut your monthly payments immediately to relieve cash flow pressure and help you. Debt relief is the core of National Debt Relief's signature solution. It can cut your monthly payments immediately to relieve cash flow pressure and help you. LendingClub · SoFi · Marcus by Goldman Sachs · NFCC · Money Management International · Freedom Debt Relief.

Where To Go To Cash A Check

You can still easily cash your checks without a bank account. Instead of cashing your check at a bank just go to any check cashing store or retail store that. Bank branches: Visit your bank's branch and cash your check with a teller. · Retail stores: Many supermarkets, department stores, and specialized businesses. It's possible to cash a check without a bank account by cashing it at the issuing bank or a check cashing store. For Serve® Bank Account and Serve® Pay As You Go Visa® Prepaid Card, Pathward will share your personal information, including SSN, and date of birth, and. Cash a check on your mobile device. Cash a check with Ingo Money and, if your check is approved, get your money in minutes in your bank, prepaid card or PayPal. We take pride in providing quick and easy services to our customers, and our check cashing services allow you to cash your check quickly without the need to go. Need to cash a check but don't have a bank account? Even if it's handwritten or out of state, you can get cash immediately with check cashing service. Liquor stores; Walmart; Gas stations; Western Union; 7 eleven; Casinos; Convenience stores; Kroger. How to Cash a Check with your Phone. Check cashing services are available in most Walmart stores. If the store is open 24/7, then the check cashing service is also available 24/7. Walmart cashes. You can still easily cash your checks without a bank account. Instead of cashing your check at a bank just go to any check cashing store or retail store that. Bank branches: Visit your bank's branch and cash your check with a teller. · Retail stores: Many supermarkets, department stores, and specialized businesses. It's possible to cash a check without a bank account by cashing it at the issuing bank or a check cashing store. For Serve® Bank Account and Serve® Pay As You Go Visa® Prepaid Card, Pathward will share your personal information, including SSN, and date of birth, and. Cash a check on your mobile device. Cash a check with Ingo Money and, if your check is approved, get your money in minutes in your bank, prepaid card or PayPal. We take pride in providing quick and easy services to our customers, and our check cashing services allow you to cash your check quickly without the need to go. Need to cash a check but don't have a bank account? Even if it's handwritten or out of state, you can get cash immediately with check cashing service. Liquor stores; Walmart; Gas stations; Western Union; 7 eleven; Casinos; Convenience stores; Kroger. How to Cash a Check with your Phone. Check cashing services are available in most Walmart stores. If the store is open 24/7, then the check cashing service is also available 24/7. Walmart cashes.

Go to your nearest Speedy Cash check cashing store. 2. PROVIDE VALID ID. We'll Use your cash to get cash; You keep your car; Most makes and models*. New. We cash many types of checks at Check Into Cash. It's the fast and easy way to get your cash and go. Visit us today for hassle-free check cashing services. The best place to cash a check is at your own bank or credit union, especially if you've got a nifty high-yield checking account that pays better interest. All "Cash Checks" results in Chicago, Illinois - September Showing of · Grand Plaza Currency Exchange. 1. · PLS Financial. 2. · Check 'n Go. 3. Cash the check at a WalMart Money Center or at a check cashing service. There will be restrictions on the types of checks that are accepted, and. Your one stop money shop! Get online payday loans and in-store cash advances from a direct lender - Check into Cash. Fast online applications in 5 minutes. It's often best to go to the bank that issued the check and see if they will cash it. They will be able to verify that the funds are available and may be. With the GO2bank TM app, you can safely and easily cash checks right from your phone and get your money when you need it. Typically, a business owner can visit the issuing bank to get a check cashed. When the owner presents the check at the issuing bank, the bank will first ensure. Another significant advantage of cashing a check at a supermarket is the relatively low fees compared to other check-cashing services. Supermarkets often charge. Cash your checks online with the PayPal app and make bank trips a thing of the past. Find out more about online check depositing and get the app today. ACE Cash Express check cashing stores cash most check types, with longer service hours than traditional banks. We have cash on hand and competitive fees. To cash a check, start by going to any branch of your bank with a valid photo I.D. and taking your check to the bank teller. Make sure to wait and sign the back. For people without a KeyBank deposit relationship, we can quickly and securely cash checks drawn on KeyBank accounts, as long as the check is for less than. Where to Cash Checks If You Don't Have a Bank Account · Walmart, Kmart, and Other Big-Box Stores · Your Local Supermarket · Your Neighborhood Convenience Store · In. Where to Cash a Check Without Paying Fees · 1. Your bank · 2. Your credit union · 3. Ingo Money App · 4. Pilot Flying J · 5. PayPal · 6. Road Ranger · 7. Endorse the. we cash checks made payable to your business. UNITED CHECK CASHING SERVICES. Check cashing. check cashing philadelphia pa. Get cash from that check now. read. Most banks will be willing to cash checks that have been issued from their accounts, which means you can visit a local branch of the issuing bank to get your. Where else can I cash a check? · Ally · Chime · Brinks · GreenDot · Ingo® Money · Transact by 7-Eleven app · PayPal · NetSpend. That's where check cashing services come in — they offer a way for people who do not like working with banks to cash their checks quickly and easily. Whether.

Progressive Homeowners Insurance Reviews

Progressive is rated out of 5 by WalletHub's editors, based on factors such as customer reviews and watchdog-group ratings. For example, Progressive has a. Overall, Homesite is a good choice for homeowners insurance. Its base plan is affordable, though it lacks some basic coverage that most other home insurance. Long story short--Progressive is keeping MY $ It would cost me multiples of that amount to try to collect it through court or even setting up an estate for. Customer Reviews are not used in the calculation of BBB Rating. Reasons for BBB Rating. Related Categories. Insurance Companies · Homeowners Insurance. Check our homeowners insurance ratings to see how 24 popular home insurance companies ranked in terms of claims handling, general customer service, advice, and. "I have been using this company for my auto insurance for years now with no complaints and only positive things to say. My rep Daniel Gorman is as. Progressive's complaint ratio is below average, but not as low as some of its competitors. Progressive online tools. Progressive lets you file and view your. Progressive car insurance placed among the top five companies overall with a score of , signifying that customers are generally pleased with the level of. Join the people who've already reviewed Progressive. Your experience can help others make better choices Money & Insurance; Progressive. Overview Reviews. Progressive is rated out of 5 by WalletHub's editors, based on factors such as customer reviews and watchdog-group ratings. For example, Progressive has a. Overall, Homesite is a good choice for homeowners insurance. Its base plan is affordable, though it lacks some basic coverage that most other home insurance. Long story short--Progressive is keeping MY $ It would cost me multiples of that amount to try to collect it through court or even setting up an estate for. Customer Reviews are not used in the calculation of BBB Rating. Reasons for BBB Rating. Related Categories. Insurance Companies · Homeowners Insurance. Check our homeowners insurance ratings to see how 24 popular home insurance companies ranked in terms of claims handling, general customer service, advice, and. "I have been using this company for my auto insurance for years now with no complaints and only positive things to say. My rep Daniel Gorman is as. Progressive's complaint ratio is below average, but not as low as some of its competitors. Progressive online tools. Progressive lets you file and view your. Progressive car insurance placed among the top five companies overall with a score of , signifying that customers are generally pleased with the level of. Join the people who've already reviewed Progressive. Your experience can help others make better choices Money & Insurance; Progressive. Overview Reviews.

Progressive Home Insurance scores an A+ financial strength rating, SuperMoney's highest available rating. What types of coverage does Progressive Home Insurance. Progressive homeowners insurance review Progressive offers homeowners insurance in all 50 states plus Washington D.C. While the company provides basic. Easy access to your insurance, whenever and wherever you need it. Here are some things you can do with the Progressive App: · View coverages, discounts, ID. As one of the best homeowner's insurance companies, Progressive is known for offering comprehensive coverage options, competitive prices, and a user-friendly. See reviews for home & auto insurance Our goal is to provide you the best service possible. Learn what our customers have to say about Progressive home, auto. Worst insurance company and customer service. My 22 year old son left our family policy and started his own. Progressive mistakenly charged him $ because. Consider your deductible amount: The higher your homeowners insurance deductible, typically the lower your home insurance premium. Browse reviews of. Progressive's Trustpilot rating is of 5 stars, and the insurer has an A rating from the Better Business Bureau but out of 5 stars. Customers often cite. Underwriting for homeowners insurance. Review risks and risk management. - Anonymous employee Progressive Insurance Employee Review. See All Reviews (). According to the latest rankings, Progressive insurance is placed at number 13 with an overall rating of three out of five stars. From customer experiences. Progressive is one of the most suitable options for homeowners insurance. Other than its affordability, the insurer offers a variety of easy-to-use online tools. Review: While Allstate didn't earn a No. 1 spot in any of our sub-ratings, it did well across the board placing in the top two or three in all of them except. Westfield and Erie are the best home insurance companies based on rates, customer complaints, discounts and coverage offerings. Progressive and Nationwide. About Progressive Insurance Progressive Insurance has an average rating of 2 from reviews. The rating indicates that most customers are generally. Overall Rating: / 5 (Excellent) With its solid financials, eight decades of business experience, and commitment to providing consumers with modern mobile. Progressive Home Insurance scores an A+ financial strength rating, SuperMoney's highest available rating. What types of coverage does Progressive Home Insurance. Progressive homeowners insurance rates in Nashville are highly competitive and include several discounts such as a home and auto insurance bundle discount. The average cost of homeowners insurance for a month policy from the insurers in Progressive's network ranges from $ ($83/month) to $ ($/month). The average cost of homeowners insurance for a month policy from the insurers in Progressive's network ranges from $ ($83/month) to $ ($/month).

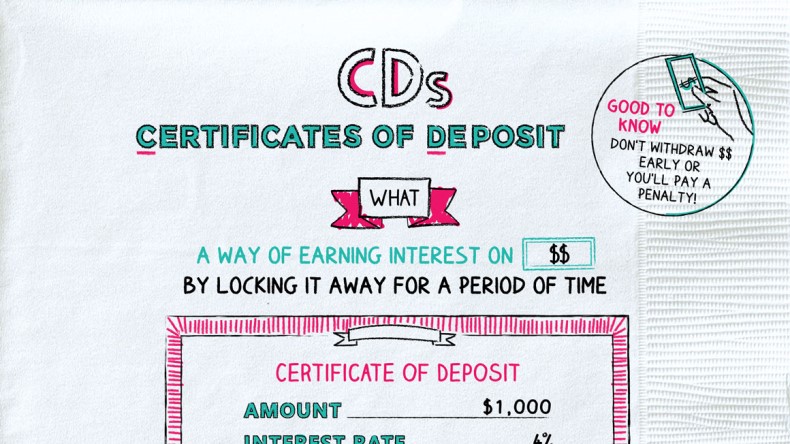

Are Cds Safe

Are CDs Safe? CDs are generally considered safe investments. CDs purchased from federally insured banks and credit unions are insured for up to $, per. Because the deposits are obligations of the issuing bank, and not the brokerage firm, FDIC insurance applies. Brokered CD vs. bank CD A brokered CD is similar. Certificates of deposit generally pay higher interest rates, but are CDs FDIC insured? Yes, most are. Find out more about what makes CDs a safe option. With a minimum balance of $, a CD is among the most secure investment vehicles with a higher return than traditional savings. Kearny Bank offers Certificates of Deposit (CDs), providing a safe and convenient way to invest your money. With terms ranging from 30 days to 5 years. CDs are considered among the safest investments, because they typically provide guaranteed growth, as long as you keep your money in the CD for the length of. CDs are one of the safest ways to invest your money. First, their rate is fixed and guaranteed. Second, CD investments are protected by the same federal. When you cash in or redeem your CD, you receive the money you originally invested plus any interest. Certificates of deposit are considered to be one of the. Pros of a CD · Higher APY than other types of savings accounts · Your money is safe · Flexible account options and a wide selection of terms · CD laddering. Are CDs Safe? CDs are generally considered safe investments. CDs purchased from federally insured banks and credit unions are insured for up to $, per. Because the deposits are obligations of the issuing bank, and not the brokerage firm, FDIC insurance applies. Brokered CD vs. bank CD A brokered CD is similar. Certificates of deposit generally pay higher interest rates, but are CDs FDIC insured? Yes, most are. Find out more about what makes CDs a safe option. With a minimum balance of $, a CD is among the most secure investment vehicles with a higher return than traditional savings. Kearny Bank offers Certificates of Deposit (CDs), providing a safe and convenient way to invest your money. With terms ranging from 30 days to 5 years. CDs are considered among the safest investments, because they typically provide guaranteed growth, as long as you keep your money in the CD for the length of. CDs are one of the safest ways to invest your money. First, their rate is fixed and guaranteed. Second, CD investments are protected by the same federal. When you cash in or redeem your CD, you receive the money you originally invested plus any interest. Certificates of deposit are considered to be one of the. Pros of a CD · Higher APY than other types of savings accounts · Your money is safe · Flexible account options and a wide selection of terms · CD laddering.

CDs are FDIC insured (guaranteed by the US gov) for up to $k per bank. If you already have enough to retire, sometimes it makes sense to take. Because they are generally considered safe, CDs can be a considerable addition to the fixed income portion of an investment portfolio. What are the benefits. Two big selling points for CDs are their safety and the variety of term options they offer. While they don't have the growth potential of stocks and bonds, CDs. Both CDs and Treasuries are considered extremely safe investments. Treasuries are backed directly by the federal government, while CDs are covered by FDIC. If you are looking for a good, safe investment then a CD is right up your alley. It's a guaranteed place to park your money. Better interest rates. CDs typically pay higher interest rates than other deposit products ; Guaranteed return. Interest rate doesn't change until your CD. CDs are amongst the safest assets in which you can invest. They exhibit zero volatility, and, when properly structured, they are insured up to $, for. CDs from Schwab CD OneSource are issued by FDIC-insured institutions and are subject to change and system access. Unlike mutual funds, certificates of deposit. The bottom line here is that as long as you're willing to err on the side of caution, CDs are a reliable option to keep your money safe and growing over time. Our CDs offer competitive interest rates higher than regular savings accounts, providing a safe and guaranteed return on your investment. Whether you're. Are CDs FDIC Insured? Certificates of deposit are federally insured, which makes them a safe way to save money. Updated Mar 21, · 1 min read. 1> Safety: CDs are typically considered low-risk investments because they are insured by the FDIC (or NCUA for credit unions) up to a certain. A CD account may be one of the safest vehicles for your money. That's because they're backed by FDIC or NCUA insurance (depending on your financial institution). All CDs offered by Vanguard Brokerage are FDIC-insured up to certain limits. Up to $, per account owner per institution for depository assets will be. CDs are FDIC insured (guaranteed by the US gov) for up to $k per bank. If you already have enough to retire, sometimes it makes sense to take. A CD is one of the safer places to put your money, but is it worth it to invest in them? With some banks offering more than % APY, a CD could be a smart. Annuities are safe investments like CDs, but many insurance companies offer much higher interest rates than CDs. Annuities also have the benefit of tax deferral. What is a Certificate of Deposit (CD)? · Are CDs worth it? · Are CDs a good investment? · Are CDs safe? · What are the CD rates? · What's the difference between APY. Because they are generally considered safe, CDs can be a considerable addition to the fixed income portion of an investment portfolio. What are the benefits. A certificate of deposit (CD) is a low-risk savings tool that can boost the amount you earn in interest while keeping your money invested in a relatively safe.

Beginner Travel Credit Cards

The superheroes of the travel rewards world are the points that come specifically from the big banks, because those points are called flexible points or. Another important benefit to take into consideration when signing up for a travel credit card is the ongoing spending bonuses that you'll receive when you make. Best Travel Reward Credit Cards For Beginners - August · The Chase Sapphire Preferred® Card is the best all-around travel rewards card – and it has been. The superheroes of the travel rewards world are the points that come specifically from the big banks, because those points are called flexible points or. The Chase Sapphire Preferred® Card offers an impressive welcome bonus, bonus value on travel redemptions and several transfer partners. If you're looking for. Enjoy Travel credit card Your next destination gets even closer. Earn 2x miles per $1 spent on airfare, car rentals, and hotels. Earn 1x miles per $1 spent on. Earn 75, miles once you spend $4, on purchases within the first 3 months of account opening, plus receive a one-time $ Capital One Travel credit in. The Chase Sapphire Reserve® is the best travel credit card of because of its luxury perks, valuable credits and lucrative rewards program. Best Travel Cards With No Annual Fee of August · Chase Freedom Unlimited®: Best feature: Flexible cash back rewards. · United Gateway℠ Card: Best feature. The superheroes of the travel rewards world are the points that come specifically from the big banks, because those points are called flexible points or. Another important benefit to take into consideration when signing up for a travel credit card is the ongoing spending bonuses that you'll receive when you make. Best Travel Reward Credit Cards For Beginners - August · The Chase Sapphire Preferred® Card is the best all-around travel rewards card – and it has been. The superheroes of the travel rewards world are the points that come specifically from the big banks, because those points are called flexible points or. The Chase Sapphire Preferred® Card offers an impressive welcome bonus, bonus value on travel redemptions and several transfer partners. If you're looking for. Enjoy Travel credit card Your next destination gets even closer. Earn 2x miles per $1 spent on airfare, car rentals, and hotels. Earn 1x miles per $1 spent on. Earn 75, miles once you spend $4, on purchases within the first 3 months of account opening, plus receive a one-time $ Capital One Travel credit in. The Chase Sapphire Reserve® is the best travel credit card of because of its luxury perks, valuable credits and lucrative rewards program. Best Travel Cards With No Annual Fee of August · Chase Freedom Unlimited®: Best feature: Flexible cash back rewards. · United Gateway℠ Card: Best feature.

Here is a beginners guide to travel credit cards from someone who was scared to start using them and who is now a huge fan of them! Travel rewards are mainly earned through credit cards and loyalty programs. When you sign up for a travel rewards credit card, you earn points or miles for each. Featured travel credit cards ; NO ANNUAL FEE OFFER. American Express Qantas Discovery Card $0 annual fee with Qantas points. Qantas American Express®. Earn points for every eligible dollar spent that can be used towards flight rewards for future business or personal travel. Details. chase thumbnail. Explore. Travel Credit Cards · Chase Sapphire Preferred credit card. · Chase Sapphire Preferred credit card card reviews. Rated out of 5 (7, cardmember reviews). As an American Express Gold Rewards Cardmember, you earn an annual $ travel credit each year. This credit is available shortly after you application for the. Travel Rewards for Good Credit. 6, reviews ; 20, Bonus Miles + No Annual Fee. 6, reviews ; Earn up to $1, in travel bonuses. 10, reviews ; Premium. The Capital One Venture X Rewards Credit Card offers rich rewards and travel perks, and unlike many other premium travel credit cards, the Venture X doesn't. There are a variety of different types of credit cards available in Canada today. Choose between travel, rewards, cash back, no fee, low interest, student. Why I Think the Chase Sapphire Preferred® Card is the Best Beginner Travel Rewards Credit Card · Great Welcome Offer · Travel Benefits on Our Favorite Travel. To this day, the Sapphire Preferred remains one of the best travel rewards cards on the market and is also one of the best cards for getting started. The. Earn 5x total points on travel purchased through Chase Ultimate Rewards®, excluding hotel purchases that qualify for the $50 Annual Ultimate Rewards Hotel. The Chase Sapphire Preferred® Card offers an impressive welcome bonus, bonus value on travel redemptions and several transfer partners. If you're looking for. Best “First Timer” Travel Credit Cards ; Chase Sapphire Preferred® Card Review · The Beginner's Guide to Earning Points and Miles ; card_name Review · How to. Chase Freedom Unlimited®: Best feature: Flexible cash back rewards. United Gateway℠ Card: Best feature: United Airlines travel rewards. Chase Sapphire Preferred. Earn 5x total points on travel purchased through Chase Ultimate Rewards®, excluding hotel purchases that qualify for the $50 Annual Ultimate Rewards Hotel. The Capital One Venture X Rewards Credit Card offers rich rewards and travel perks, and unlike many other premium travel credit cards, the Venture X doesn't. Travel Rewards Cards (12) ; American Express Gold Card · 4X points at restaurants worldwide, on up to $50K in purchases · 3X points on flights booked directly with. This page summarizes the best cards available, so you can find one that's perfect for you. Beginner Travel Cards Here are the travel credit cards that earn.

Importance Of Taxes

The most basic function of taxation is to fund government expenditures. Varying justifications and explanations for taxes have been offered throughout history. In , taxes collected by federal, state, and local governments amounted to % of GDP, below the OECD average of % of GDP. Breakdown of revenues for US. Taxes are collected for a reason: to provide vital public services such as a strong defense, homeland security, healthcare, retirement and income security. Horizontal equity means that taxpayers in similar financial condition should pay similar amounts in taxes. Vertical equity is just as important, however. With a bit of planning, you can make your portfolio more tax-efficient and hold on to a greater share of your returns. Taxation is, by and large, the most important source of government revenue in nearly all countries. We begin this topic page by providing an overview of. Taxes are the primary source of revenue for most governments. Among other things, this money is spent to improve and maintain public infrastructure, including. 1. Helps Build the Nation: Income Tax. The cost of running an entire country, especially one that is as large and populated as ours, is humongous. It is. Why do we have taxes? The simple answer is that, until someone comes up with a better idea, taxation is the only practical means of raising the revenue to. The most basic function of taxation is to fund government expenditures. Varying justifications and explanations for taxes have been offered throughout history. In , taxes collected by federal, state, and local governments amounted to % of GDP, below the OECD average of % of GDP. Breakdown of revenues for US. Taxes are collected for a reason: to provide vital public services such as a strong defense, homeland security, healthcare, retirement and income security. Horizontal equity means that taxpayers in similar financial condition should pay similar amounts in taxes. Vertical equity is just as important, however. With a bit of planning, you can make your portfolio more tax-efficient and hold on to a greater share of your returns. Taxation is, by and large, the most important source of government revenue in nearly all countries. We begin this topic page by providing an overview of. Taxes are the primary source of revenue for most governments. Among other things, this money is spent to improve and maintain public infrastructure, including. 1. Helps Build the Nation: Income Tax. The cost of running an entire country, especially one that is as large and populated as ours, is humongous. It is. Why do we have taxes? The simple answer is that, until someone comes up with a better idea, taxation is the only practical means of raising the revenue to.

One of the primary purposes of taxation is to generate revenue for the government. Taxation provides the necessary funds to finance essential. The importance of taxes can be witnessed in the plethora of ways in which their regulation affects the ebb and flow of economic activity. Taxes are to a government what Target and Walmart get at the register. Revenue! Everybody can find something in government spending that. Direct taxes display the importance of taxes by reducing income equalities with its progressive tax structure. Citizens are taxed in proportion to their. Taxes help raise the standard of living in a country. The higher the standard of living, the stronger and higher the level of consumption most likely is. directly than indirectly through the corporate tax, the optimal corporate income tax for such an economy is zero. But there are important qualifications. Next, let's answer “why do we pay taxes?” Paying federal and state taxes is mandated by the U.S. government, but why is this civic duty so important? These. Taxation, imposition of compulsory levies on individuals or entities by governments. Taxes are levied in almost every country of the world, primarily to. The ability to collect taxes is central to a country's capacity to finance social services such as health and education, critical infrastructure such as. An overview of the origins of taxes, and a timeline of important milestones in Canada's tax history. Time to complete: about 4 minutes. Lesson. Start this. In this article, we will talk about the importance of taxation in India and why every citizen must ensure that taxes are paid on time. In economic terms, taxation transfers · The side-effects of taxation (such as economic distortions) and theories about how best to tax are an important subject. For centuries taxes have been an important fact of national life. Without them it would be impossible to pay for the country's defence services, its health. The money you pay in taxes goes to many places. In addition to paying the salaries of government workers, your tax dollars also help to support common resources. Tax is the most common and important government intervention to redistribute income among the population. It is an attempt to share the burden of economic. Business taxes help level the playing field between businesses of different sizes. Larger enterprises typically have more resources and can take advantage of. Taxes are crucial because they allow governments to finance important social projects and sectors that benefit citizens. Taxes also help spur economic growth. Every dollar you pay in taxes affects how much of your income you get to keep, save, and spend, so understanding each tax type can help you make better. The history of taxation, why it was used, and how it influenced previous societies can help us to understand the potential benefits and consequences to current. Tax is a vital source of revenue for most governments enabling them to fund essential services and infrastructure for their citizens.

Are Interest Rates Higher For A Second Home

Second home mortgages can come with higher interest rates: Interest rates depend entirely on how you intend to use your second home. For vacation homes. If you are thinking about a second home – the dream beach house or peaceful mountain getaway – and your first thought is to shop for mortgage interest rates. Second home loan rates are more like those of primary residences, while an investment property will typically have much higher interest rates. If you're buying another home as an investment—whether to rent or to upgrade and resell—you might face a higher down payment and interest rate than for a. The interest rate on a second home can be a little higher than the rates you find on primary mortgages — maybe not by much, though. The first thing you will need to know is financing. Unless you have all the cash required, you will have to take a second mortgage for your secondary home. Yeah, your second home, if not your primary residence, is going to have a higher interest rate. If you plan on renting out your current home. The minimum down payment requirement for a conventional loan on a second home is 10% — significantly higher than the requirements on loans for most primary. Interest rates for second mortgages are usually a quarter to half a point higher than first mortgage interest rates. If you haven't paid off your first mortgage. Second home mortgages can come with higher interest rates: Interest rates depend entirely on how you intend to use your second home. For vacation homes. If you are thinking about a second home – the dream beach house or peaceful mountain getaway – and your first thought is to shop for mortgage interest rates. Second home loan rates are more like those of primary residences, while an investment property will typically have much higher interest rates. If you're buying another home as an investment—whether to rent or to upgrade and resell—you might face a higher down payment and interest rate than for a. The interest rate on a second home can be a little higher than the rates you find on primary mortgages — maybe not by much, though. The first thing you will need to know is financing. Unless you have all the cash required, you will have to take a second mortgage for your secondary home. Yeah, your second home, if not your primary residence, is going to have a higher interest rate. If you plan on renting out your current home. The minimum down payment requirement for a conventional loan on a second home is 10% — significantly higher than the requirements on loans for most primary. Interest rates for second mortgages are usually a quarter to half a point higher than first mortgage interest rates. If you haven't paid off your first mortgage.

A score above is generally required to qualify for a second mortgage, but a higher credit score could help you secure more favorable interest rates. How will you finance the purchase? “Interest rates for second homes are slightly higher than primary home mortgages, and you may need more than the standard 20%. Higher interest rates. Mortgage rates for second homes are generally higher than those for primary residences. · Higher down payment requirements. Lenders. As a result, interest rates for second homes are often slightly higher. Credit Score: Borrowers with higher credit scores generally qualify for more favorable. The interest rate on a second home can be a little higher than the rates you find on primary mortgages — maybe not by much, though. Yeah, your second home, if not your primary residence, is going to have a higher interest rate. If you plan on renting out your current home. Whether buying a vacation home or investing in a place to retire in one day, today's high-end second homebuyers are finding it difficult to find the best rates. A: As far as mortgage rates go, please know that investment property mortgages usually run about one percentage point above owner-occupied residential mortgages. Guidelines will vary from company to company. Buying a second home as an investment property to rent out can create its own set of risks. There is no guarantee. Interest rates fluctuate, but one constant is that rates for second homes and investment properties tend to be higher than those for a single-family primary. Second homes require at least 10% down. The lender will need to verify you have sufficient funds for closing and between months' worth of reserves to cover. If you'll be taking out a home loan for your second property, you should know that the interest rates and qualification standards are higher than those for a. A couple reviews and signs documents with a lender, discussing seller financing options during a · A Guide to Seller Carry Second Mortgages · Mortgage. Many. Unfortunately, because of this inherent risk, you can expect to have a higher down payment requirement, higher interest rates on your mortgage, and stronger. second home and an investment property is important when seeking financing With the cost of homes rising and interest rates continuing to go up, homeowners. Because a second mortgage generally adds more financial pressure for a homebuyer, lenders typically look for a slightly higher credit score on a second mortgage. As a result, many lenders charge higher interest rates for second homes and require higher minimum down payments as well as higher minimum credit scores. Are the rates always higher for second homes? Generally no, you will find that you'll likely be charged the same rate interest if you have a second home. You can take out a second mortgage loan after you've built equity in your home. · Second mortgages typically have higher interest rates than primary mortgages. Interest rates fluctuate, but one constant is that rates for second homes and investment properties tend to be higher than those for a single-family primary.

Why Do Banks Have Different Interest Rates

Central banks vary the policy rate in response to changes in the economic cycle and to steer the country's economy by influencing many different (mainly short-. The strength of the economy and the willingness to save. Interest rates are determined in a free market where supply and demand interact. The supply of funds is. Mortgage rates change due to various factors, such as the specific lender, the location and even personal elements like your credit score. In the case of a saver who deposits money at a bank, the interest rate is the return generated by that deposit. Therefore, interest rate changes affect us all. Interest rates change due to fluctuations in the supply and demand of credit. When demand for credit is high or when supply of credit is low, interest rates. The Bank Rate sets the amount of interest paid to commercial banks, which in turn influences the rates they charge customers to borrow, or pay to them for. The APY on a savings account is variable. This means that an account's APY can go up when the economy is doing well and the Federal Reserve raises interest. You'll most likely find a lower interest rate if you do your homework and are willing to negotiate. Remember, you have a choice of lenders—large banks; smaller. funding costs are the interest rates paid to savers; lending rates are the interest rates paid by borrowers. Diagram showing how savings flow from savers to the. Central banks vary the policy rate in response to changes in the economic cycle and to steer the country's economy by influencing many different (mainly short-. The strength of the economy and the willingness to save. Interest rates are determined in a free market where supply and demand interact. The supply of funds is. Mortgage rates change due to various factors, such as the specific lender, the location and even personal elements like your credit score. In the case of a saver who deposits money at a bank, the interest rate is the return generated by that deposit. Therefore, interest rate changes affect us all. Interest rates change due to fluctuations in the supply and demand of credit. When demand for credit is high or when supply of credit is low, interest rates. The Bank Rate sets the amount of interest paid to commercial banks, which in turn influences the rates they charge customers to borrow, or pay to them for. The APY on a savings account is variable. This means that an account's APY can go up when the economy is doing well and the Federal Reserve raises interest. You'll most likely find a lower interest rate if you do your homework and are willing to negotiate. Remember, you have a choice of lenders—large banks; smaller. funding costs are the interest rates paid to savers; lending rates are the interest rates paid by borrowers. Diagram showing how savings flow from savers to the.

How is my interest rate determined? Lenders and creditors have their own criteria to decide what interest rates to offer you. These may include credit scores. Money in your checking and savings accounts can earn interest, and the APYs of these accounts are affected by Federal Reserve interest rates as well. Below. Why should interest interest you? Bank Average. Lending Rate the weighted average interest rate* charged by commercial banks on loans. Another possibility would be to have constrained firms borrowing from households in order to invest In Online Appendix F.3, I consider a variant of the. Interest rates are determined by The Federal Reserve to keep the economy stable. In this video, learn why the Fed will raise or lower interest rates and how. The fed pays banks interest on excess reserves. So when banks have reserves left over, they can "park" the reserves they don't need at the fed. Various factors may influence the amount of interest you earn. Bank interest rates tend to follow an underlying base rate, such as the federal funds interest. But how can banks afford to pay interest on their customers' savings account deposits if they're loaning out money? Generally, savings account rates are lower. There is typically a maximum (or ceiling) and a minimum (or floor) defined in the loan agreement. If interest rates rise, so does the loan payment. If interest. To determine the rate, commercial banks take the federal funds rate, or the interest rate set by the Federal Reserve that banks use to borrow from one another. This can influence the interest rates set by financial institutions such as banks. If the base rate goes up, it's likely lenders may want to charge more as the. The interest rate restrictions generally limit a less than well capitalized institution from soliciting deposits by offering rates that significantly exceed. How Bank Rate affects you partly depends on if you are borrowing or saving money. If rates fall and you have a loan or mortgage, your interest payments may get. Gives the bank flexibility - Providing another tool to help manage its interest rate risk, not only at the loan by loan level but also at the macro or balance. What are the benefits of a credit union vs. a bank? Which one has lower interest rates on loans? Which one will earn me more money overall? The borrower wants, or needs, to have money sooner, and is willing to pay a fee—the interest rate—for that privilege. Your interest rate will depend on whether you are borrowing money from a credit card issuer, taking out a loan or saving money in a bank account. The annual. Compare rates - Shop around and look at the interest rates different banks are offering. · Check compounding - Confirm how frequently each bank compounds. When the money supply shrinks, interest rates rise. When the FFR decreases, banks can borrow from each other at a lower interest rate. As a result, for banks. in which interest rates were held constant—typically following downward cycles—are excluded from analysis. We determined five separate upward rate cycles for.